Forecasting S&P 500: Utilizing RNN on Historical Stock Data for Precise Market Analysis and Prediction 📊📈

The stock market can be a challenging place to navigate, with countless factors influencing the rise and fall of stock prices. However, with the right tools, investors can make informed decisions and maximize their profits. That's where Recurrent Neural Networks (RNN) come in - they offer a powerful way to analyze historical data and make predictions about future market trends.

In this article, we'll explore how RNN can be used to analyze historical stock data for all current S&P 500 companies, providing valuable insights for investors. By training an RNN on this data, we can make predictions about future market trends with a high degree of accuracy.

To get started with MindsDb, follow these two simple steps:

Step 1:

Sign up to MindsDb here to use the cloud editor or deploy your instance using this guide. If you're using the cloud editor, you will need to upgrade to pro if you are planning to use it for Production.

Step 2:

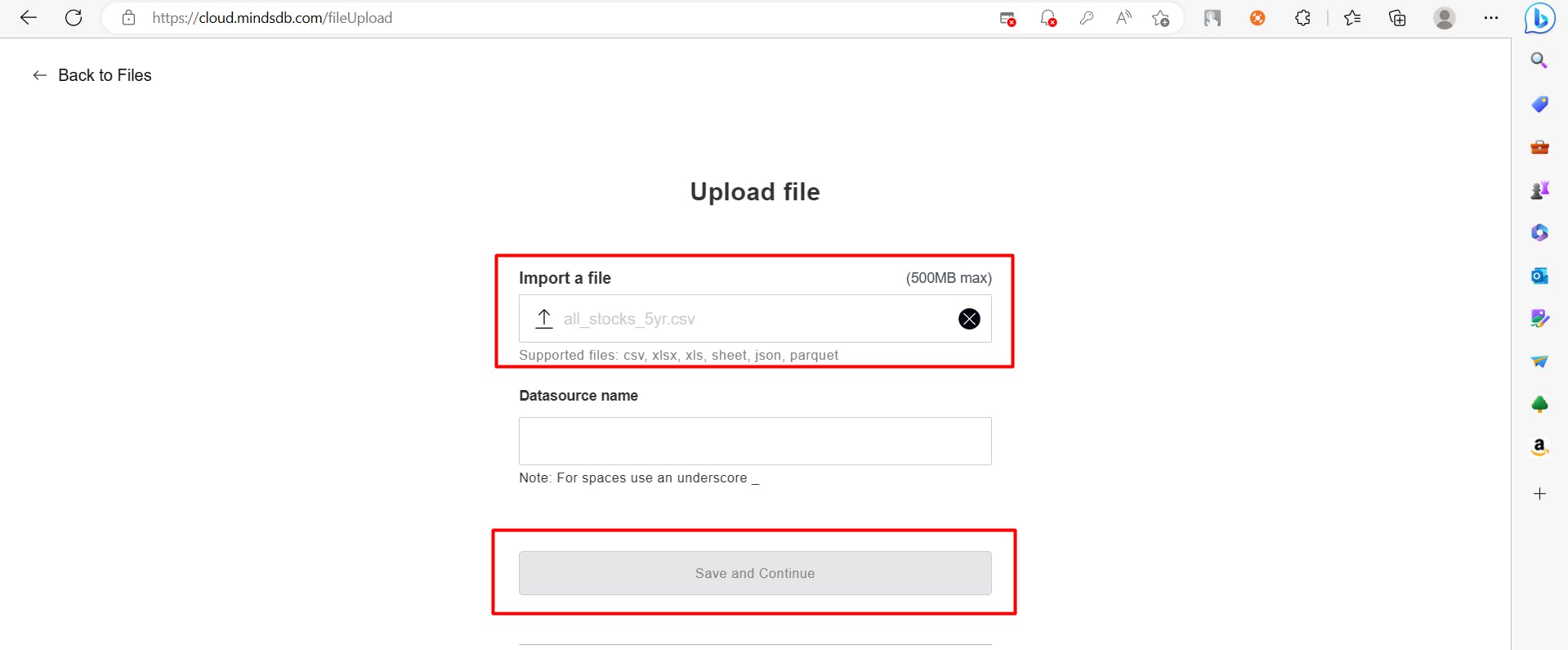

Once you're signed up and ready to go, the next step is to upload your data file. MindsDb works on a file-based system for tables, so any files in formats like JSON, xlsx, or CSV will be converted into database tables automatically.

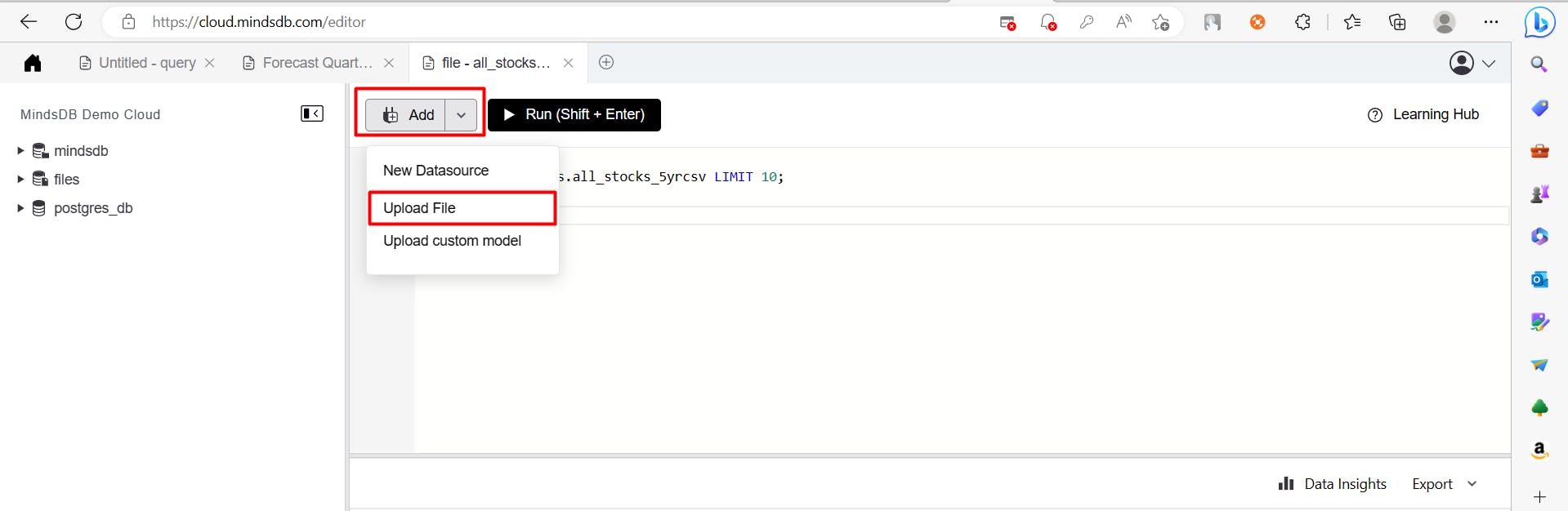

Click on the "Add" button in the MindsDB Cloud Editor interface, and select "Upload File" from the dropdown menu that appears.

Select the CSV file that you downloaded earlier, and give it a name in the "Datasource Name" field - this will be the name of your table. Then, click on "Save and Continue" to proceed.

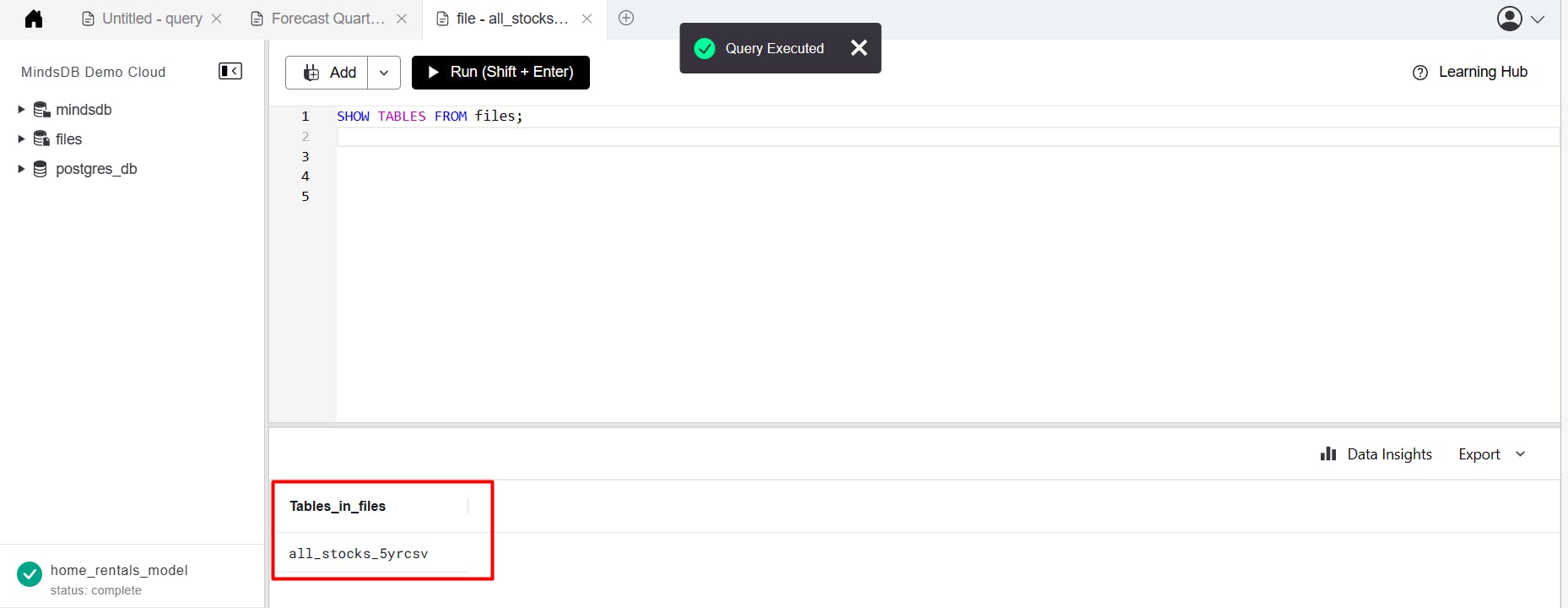

Once the file has been uploaded successfully, you will be directed to the MindsDB Cloud Editor interface. Here, you will find two basic queries. To view the available tables, execute the first query by typing the following command:

SHOW TABLES FROM files;

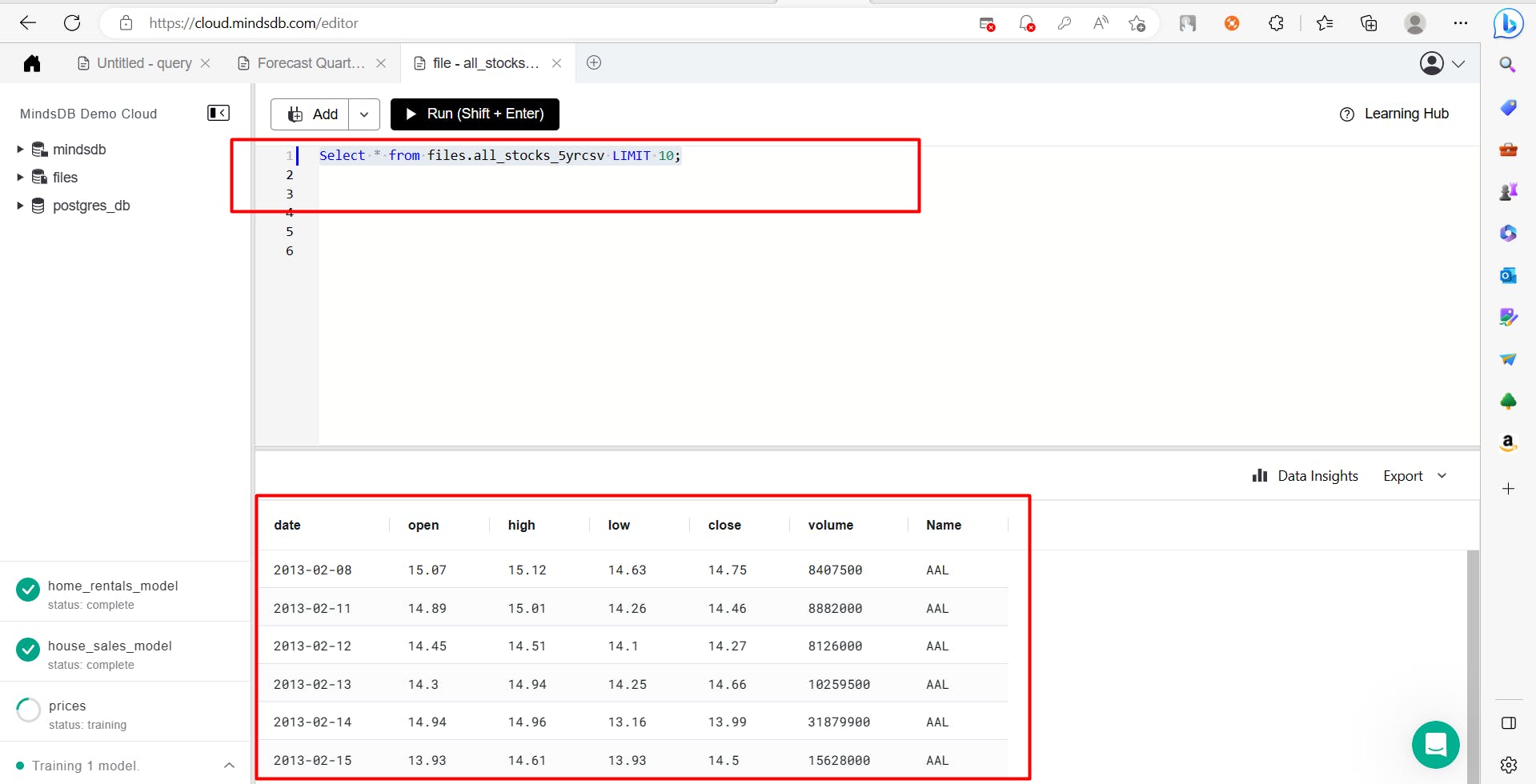

Understand the structure of the data

Select * from files.all_stocks_5yrcsv LIMIT 10;

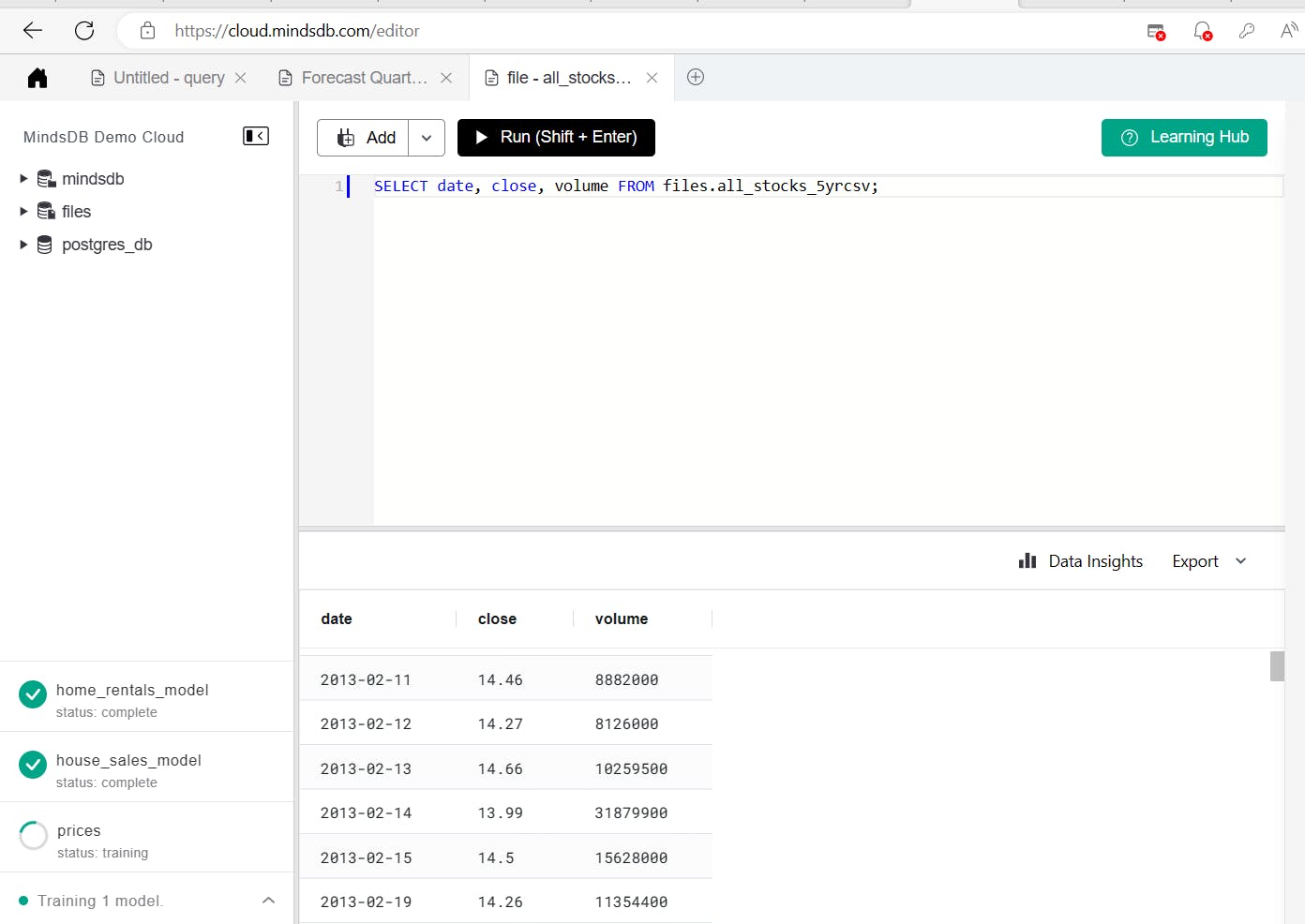

SELECT date, close, volume FROM files.all_stocks_5yrcsv;

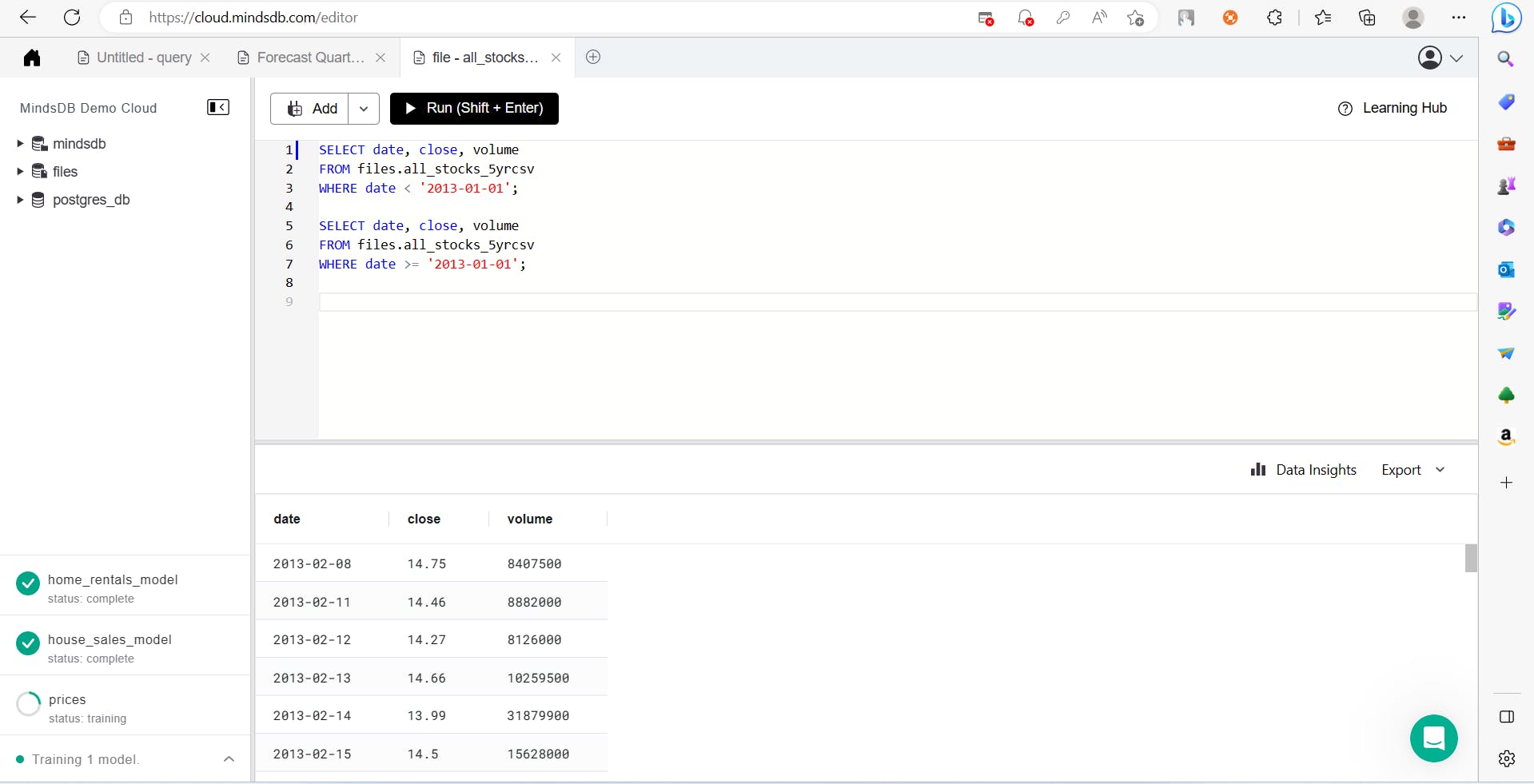

Split the data into training and testing sets

SELECT date, close, volume FROM files.all_stocks_5yrcsv WHERE date < '2013-01-01';

SELECT date, close, volume FROM files.all_stocks_5yrcsv WHERE date >= '2013-01-01';

More analysis, preprocessing, and exploration can be done on the data for a better and more accurate prediction. Additionally, the model hyper-parameters can be fine-tuned further.

Utilizing RNN on historical stock data for all current S&P 500 companies can provide valuable insights for investors looking to navigate the stock market. By taking advantage of the power of machine learning, investors can make more informed decisions and maximize their profits.

Conclusion

MindsDB is an open-source tool that simplifies the process of building and deploying machine learning models. Its easy-to-use interface enables users to train models without extensive knowledge of complex algorithms. It's a go-to solution for building ML models quickly. Check out their documentation. to explore more features.

All the commands and data used have been uploaded to GitHub: https://github.com/rohit190183107010/Historical-stock-data-for-all-current-S-P-500-companies.